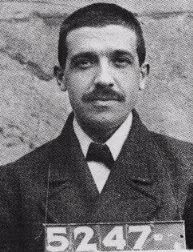

3) Charles Ponzi

3) Charles PonziIt was one of the biggest swindlers in US history. In one of Charles Ponzi’s early scams around 1920, he offered investors a 50% return on their money in 45 days, or a doubling of their money in 90 days. By February 1920, Ponzi’s best-known scam had taken in $5,000, by March, he was up to $30,000.

At that time Ponzi began hiring agents to expand his swindle. By pushing his impressive high rate of return, he could often persuade would-be investors to send money. In May 1920, he was up to $420,000 and by July 1920, he was up to millions.

About 40,000 people invested about $15 million all together; in the end, only a third of that money was returned to them. Ponzi was indicted on 86 counts of mail fraud and sentenced to five years in prison in 1920.

INFORMATION CLUB

INFORMATION CLUB Informative Zone

Informative Zone Financial Literacy

Financial Literacy 10 financial frauds that shook the world

10 financial frauds that shook the world INFORMATION CLUB

INFORMATION CLUB Informative Zone

Informative Zone Financial Literacy

Financial Literacy 10 financial frauds that shook the world

10 financial frauds that shook the world